As referenced in today’s stock market notice, DNB Markets, Nordea and SEB acted as Joint Lead Managers and Sustainability Structuring Advisors in the transaction.

Upon closing, the unsecured bond issue was substantially oversubscribed and driven by a high-quality and ESG (Environmental, Social and Governance) focused orderbook.

The issue size was set to NOK 850 million with a maturity date in January 2025. Proceeds from the bond issue will be used to refinance existing bonds and for general corporate purposes. The bond is intended to be listed on Oslo Børs and Euronext ESG Bonds.

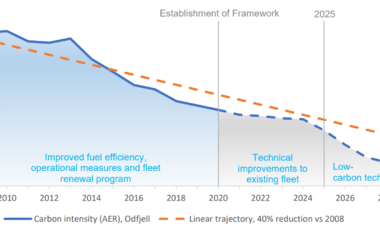

The bond issue is the first to be issued under a newly established Sustainability-Linked Finance framework, and is linked to Odfjell’s fleet transition plan and ambition to reduce the carbon intensity of its controlled fleet by 50% by 2030 compared to 2008 level.

“With this sustainability-linked bond, we prove our strong commitment to reduce emissions and build a more sustainable shipping industry. Odfjell has for many years worked actively to drive change and reduce our carbon footprint, and we are now pleased to see that investors and banks support us through this sustainability-linked bond.”

Kristian Mørch, CEO

The sustainability-linked bond marks a first not only for Odfjell, but also for the international shipping industry, and for the Nordic region across all industries.

“The shipping industry plays a vital role in the green transition. With Odfjell’s clear commitments, decarbonization strategy and ambitious CO2 emission reduction targets, they show the way as a leading company in the industry. By linking their CO2 emission reduction target with their bond financing terms, they further bolster their commitments and inspire other peers to follow. We are humble and grateful for being selected as facilitators of this hallmark transaction and supporting Odfjell on their sustainability pathway”

Joint Lead Managers at DNB, Nordea and SEB

Odfjell recently launched climate targets that go beyond IMO’s targets, and we are already well underway. Since 2008, we have run several improvement and efficiency programs, resulting in an almost 30% reduction in carbon intensity. The new climate targets are a part of our strategy on environmental, social and governance elements of the business.

For further information, please contact:

Investor Relations: Bjørn Kristian Røed, VP Corporate Analysis & Investor Relations

Tel: +47 40 91 98 68

E-mail: bkr@odfjell.com

Finance: Terje Iversen, CFO

Tel: +47 93 24 03 59

ESG: Øistein Jensen, Chief Sustainability Officer

Tel: +47 952 61 241

Media: Anngun Dybsland, Head of Communications

Tel: +47 41 54 88 54

E-mail: media@odfjell.com