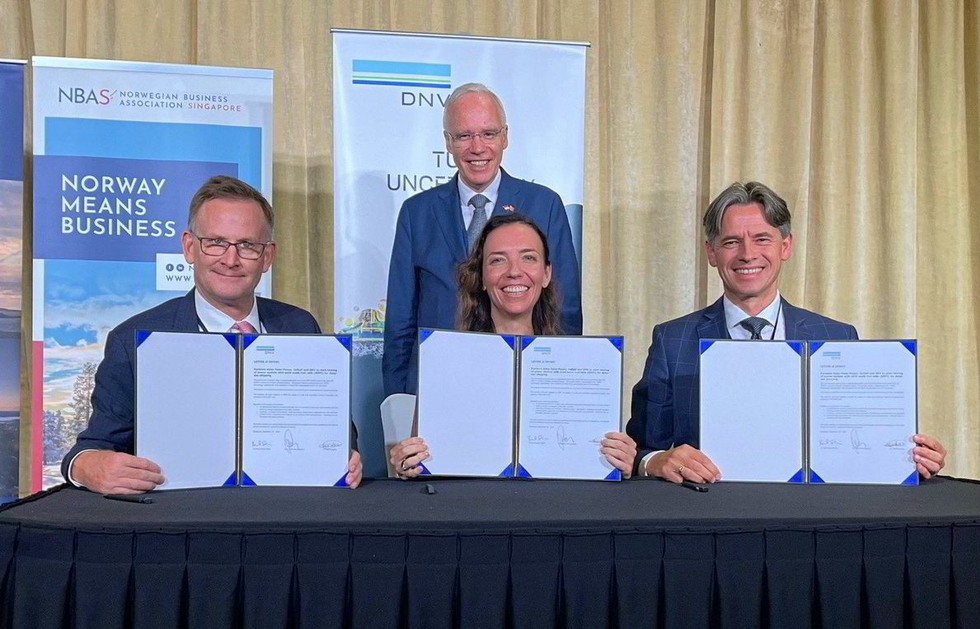

From the launch at the Singapore Norway Innovation Conference. Chairman of Odfjell, Laurence Odfjell, DNV's Regional Director in Asia, Cristina Saenz de Santa Maria, along with Bernt Skeie of Alma Clean Power. In the background is Eivind Homme, the Norwegian Ambassador in Singapore. Photo: Odfjell/Alma.

Hydrogen falls short

"In Odfjell, we are enthusiastic about both the technology and the project," says Harald Fotland to Kystens Næringsliv. He explains that the driving force behind Odfjell's involvement, both in terms of vessels and financial support, is the environmental requirements and economics within the maritime sector. While other segments can utilize hydrogen and large battery packs, the deep-sea fleet lacks a wide range of alternative fuels.

"We cannot carry the amount of hydrogen we need for deep-sea voyages. It would require either huge tanks or extremely expensive tanks," Fotland explains.

Odfjell has a longstanding partnership with Alma Clean Power. Fotland notes that the shipping company saw the potential of fuel cell technology developed by the Bergen-based company early on. What initially started as a desire for an auxiliary engine has turned into an entirely different and long-term project.

"We acknowledge that this is pioneering work and that it takes time."

13 Billion USD market

Alma Clean Power has been developing solid oxide fuel cells, which can be powered by ammonia, for many years. In July 2023, the first test facility with a capacity of 6 kilowatts was inaugurated, marking the highest power output measured from this type of cell so far.

In comparison, the market potential is massive.

"We are talking about a market worth 13 billion USD within shipping alone. For the oil and gas sector, it's even higher," said Alma Clean Power CEO Bernt Skeie to Kystens Næringsliv at the time.

According to Fotland, things will move quickly from here.

"When the testing period is over, the module will be transferred to one of our vessels, likely around October next year. The specific vessel is not yet determined. It will probably be one of the newest additions to the Odfjell fleet, depending on which vessel is due for drydock when the first modules are ready."

One of Odfjell's many chemical tankers, Bow Prosper. Photo: Jonathan Atkin

A sign of progress

"We are thrilled about this agreement, especially since it involves the deep-sea segment. For us, it's a sign that what we are doing is right when Odfjell takes this step," says Ina Ekeberg to Kystens Næringsliv.

Ekeberg is responsible for customer development at Alma Clean Power.

Now, the first cell will be built and prepared at the Energy House testing center in Norway. It will be tested both with and without carbon capture in an environment as close to maritime conditions as a concrete floor can provide. This part of the testing will continue until the end of the year before moving to the next stage.

"Energy House is constructed like a ship on land, even though the tests to be conducted are much more detailed than standard ship operations."

By the end of 2024, the power production will be connected to the ship's electrical grid.

Alma Clean Power's test module at Energy House on Stord. Now, from 6 kilowatts, it will be scaled up to 80 kilowatts, marking the first step out to sea. Photo: Alma Clean Power.

Beneficial for the environment

Odfjell owns one of the world's largest fleets of chemical tankers and is heavily investing in green efficiency and technology.

"With an engine that delivers the same amount of energy with half the regular consumption, it's better for the environment regardless. If we switch to bioethanol or ammonia, for example, the carbon footprint decreases further, and we still consume less for the same output," Fotland explains.

DNV, the classification society, is also involved in the project, primarily to identify risk levels. Alma Clean Power's Ekeberg is particularly pleased about this.

"We believe that by working with rulemakers, we will accelerate the qualification of the technology."

Fotland doesn't foresee significant safety issues at this stage.

"We are not concerned about safety, at least not with the fuel cells themselves. Any concerns would likely revolve around handling ammonia as a fuel. At the same time, we are glad to have DNV as part of the project, which will help us establish good practices and processes around the technology."

Lifetime and cost will determine success

While Fotland is enthusiastic about the concept, he also takes a pragmatic view of the testing period ahead.

"Two things need to be documented before the technology can compete with traditional engines. One is the lifetime of the fuel cells, and the other is the price of a commercial version of the engine."

CEO Harald Fotland

SOFCs are fuel-neutral, unlike many similar solutions that heavily rely on hydrogen. The key lies in combustion at much higher temperatures than in, for example, hydrogen-powered cars.

"We cannot carry the amount of hydrogen we need for deep-sea voyages. It would require either huge tanks or extremely expensive tanks," Fotland explains. Initially, natural gas (LNG) will be tested in the versatile cells. Fotland is not concerned about the availability and infrastructure surrounding ammonia, for instance, and believes that the many producers entering the market is a positive development. The flexibility to use ammonia, LNG, methanol, and hydrogen provides reassurance.

"In reality, almost anything can be burned in this type of fuel cell."